s corp tax rate calculator

The compensation salary and. Key Takeaways on how to start an S corp.

Corporate Tax Meaning Calculation Examples Planning

Are S corp tax benefits right for you.

. MLPFS is a registered broker-dealer registered investment adviser Member Securities Investor Protection SIPC popup and a wholly owned subsidiary of Bank of America Corporation BofA. At last we come to an incredible tax strategy. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for a 5y6m ARM 7 years for a.

Mortgage rates valid as of 28 Jun 2022 0947 am. Why an LLC is the best business structure for the S corp tax status. And grow into a well-established company is a dream come true for entrepreneurs.

Easily calculate your tax rate to make smart financial decisions Get started. The minimum tax for the Assumed Par Value Capital Method of calculation is 40000. Check out our S Corporation Tax Calculator.

Actual results will vary based on your tax situation. EDT and assume borrower has excellent credit including a credit score of 740 or higher. How An S Corp Can Help.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Technology provided by PropertyInfo Corp a Stewart Company. Form a formal business structure such as an LLC or corporation.

The S Corp is a business entity that offers significant tax advantages while still preserving your ownership flexibility. Technology provided by PropertyInfo. STGC does not make any express or implied warranties with regard to the use of the Stewart Rate Calculator and shall not be responsible for any errors or omissions or for the results obtained from the use of such information.

S Corps allow owners involved with day to day operations to be compensated in ways that arent only considered earned income. Find my W-2 online. Our S Corp Tax Rate guide explains how S corp taxes work and how to determine if an S corp is right for your business.

Elect S corp status from IRS Form 2553 in NYC also form CT-6 Meet all S corp IRS requirements. If an amendment changing your stock or par value was filed with the Division of Corporations during the year issued shares and total gross assets within 30 days of the amendment must be given for each portion of the year during which each distinct. Prior Year Taxes.

STGC does not make any express or implied warranties with regard to the use of the Stewart Rate Calculator and shall not be responsible for any errors or omissions or for the results obtained from the use of such information. Its in your best interest to file right away to minimize other problems like. S-corp income tax return deadline.

While less flexible than regular LLCs in some ways the S Corp can be a great way to reduce your self employment taxes. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. But as your company grows your tax rate tends to grow too.

The overall audit rate is low. Citizen or permanent. Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No.

If youre a solopreneur making at least 60000 in earnings with 20000 in annual distributions looking for tax savings let Collective start your S corp handle your monthly accounting and more. When calculating your return on investment use our after-tax rate of return calculator to accurately determine your return on investments.

S Corp Payroll Taxes Requirements How To Calculate More

S Corp Tax Calculator Scorporation Taxes Taxpreparer Taxprofessional Taxpreneur Atlanta Georgia Scorp Scorp Payroll Taxes Llc Taxes Savings Calculator

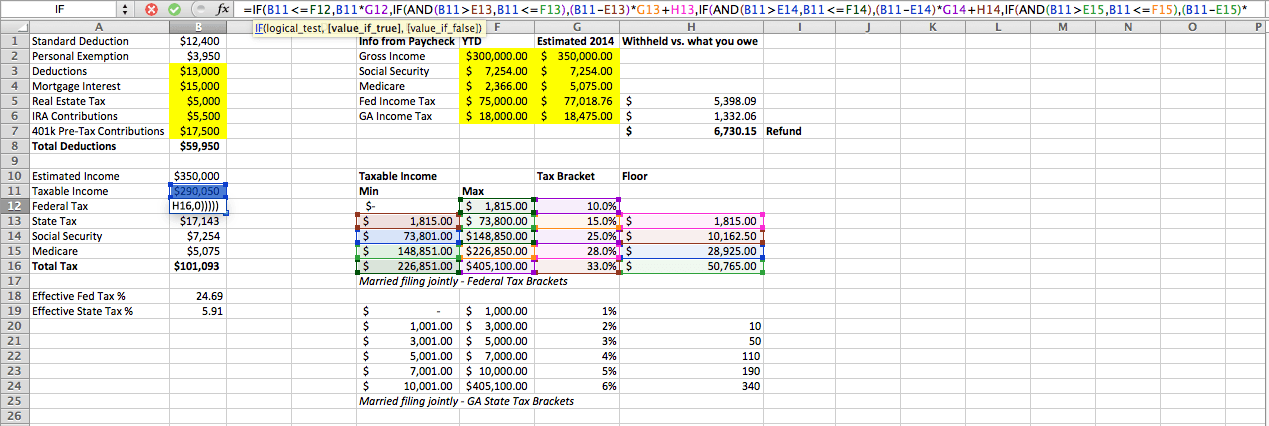

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Taxtips Ca Business 2020 Corporate Income Tax Rates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Tax Calculator Free Estimate Tax Debt Business Tax Tax Debt Relief

4 Tax Saving Strategies How To Pay Yourself From Your Business Part 2 Llc Vs S Corp Vs C Corp Youtube

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

How Much Does A Small Business Pay In Taxes

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Excel Formula Income Tax Bracket Calculation Exceljet