does kansas have an estate or inheritance tax

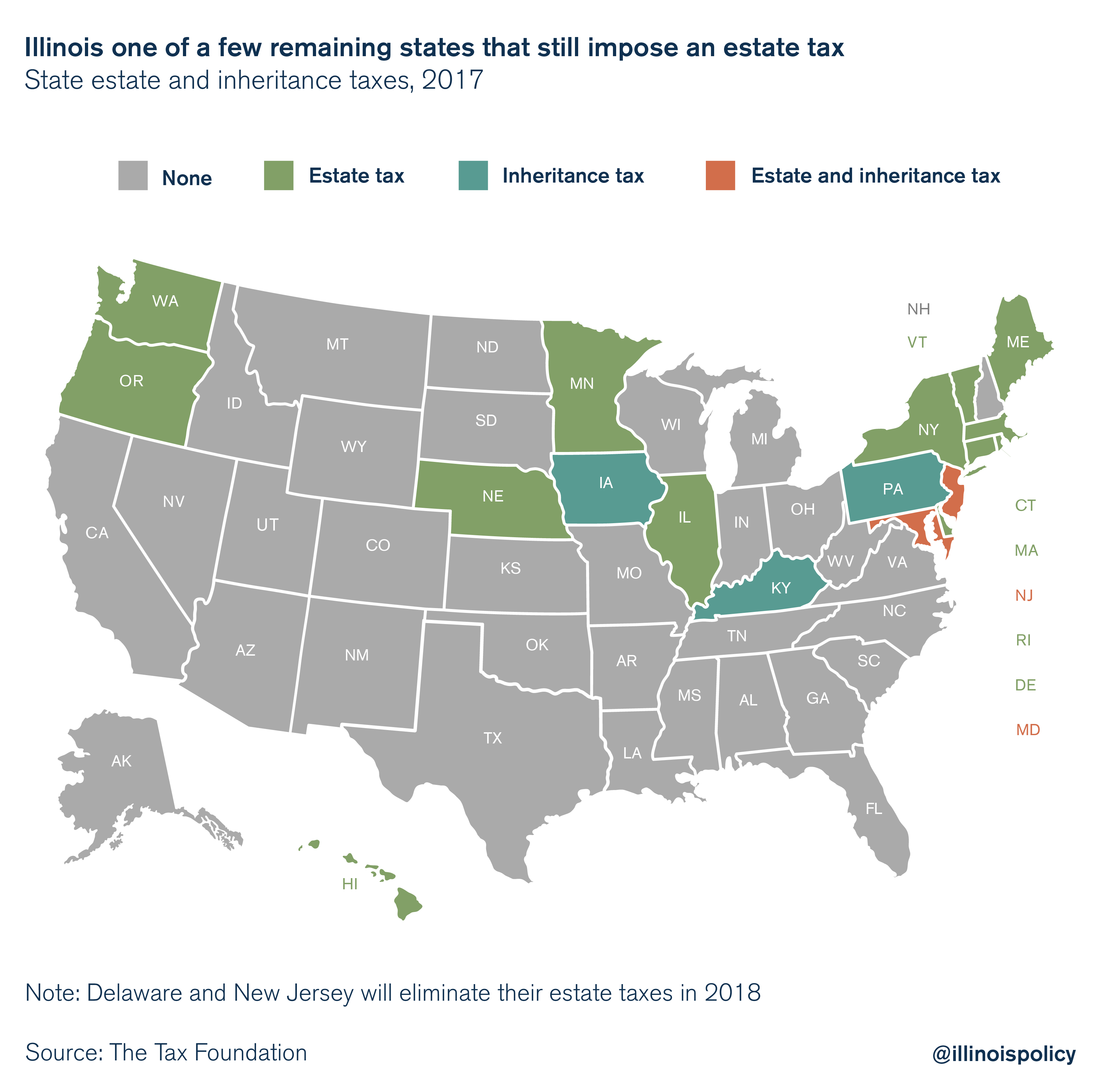

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from. Kansas does not collect an estate tax or an inheritance tax.

Estate And Inheritance Tax State By State Housing Gurus

If you live in Kansas and you inherit from a decedent in a.

. Impose estate taxes and six impose. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. Only six states have an inheritance tax.

If you are only. If you want to avoid this completely do not reside in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania when you die. Wisconsin does have several tax credits available.

However if you receive an inheritance from another state you may be subject to that states estate or inheritance tax. Homestead tax credit towards up to 1168. The ohio estate tax was repealed.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Earned income tax credit worth up to 13 of your federal earned income tax credit. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The Ohio estate tax was repealed as of January 1 2013 under Ohio. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

The state of Kansas does not place a tax on estates or inheritances. Hi does kansas have an inheritance tax. Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances.

However if you are inheriting property from another state that state may have an estate tax that applies.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Four Join New Kc Estate Planning Hall Of Fame Kansas City Business Journal

Estate And Inheritance Taxes In Oklahoma Basic Ideas Managing Opti

State Estate And Inheritance Taxes Itep

How Much Is Inheritance Tax Probate Advance

Assessing The Impact Of State Estate Taxes Revised 12 19 06

States With No Estate Tax Or Inheritance Tax Plan Where You Die

As Other States Repeal Illinois Death Tax Remains

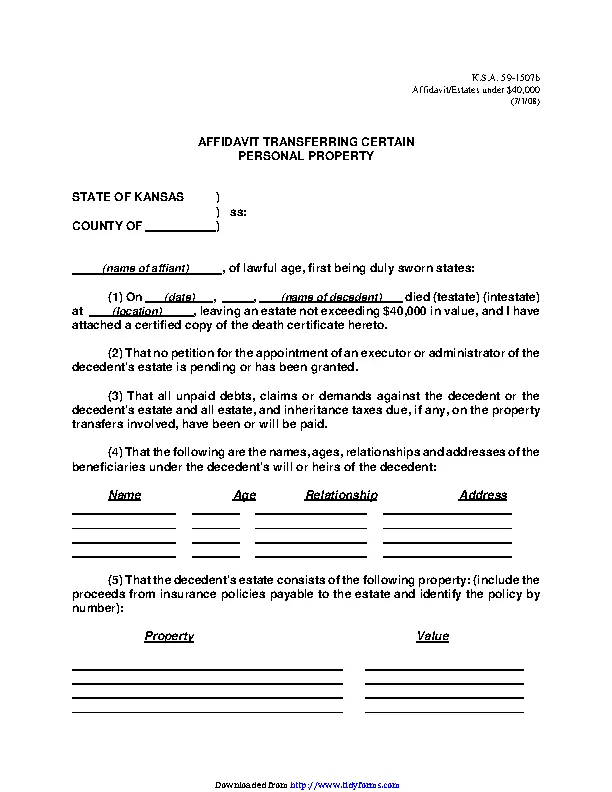

Kansas Affidavit Transferring Certain Personal Property Form Pdfsimpli

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas And Missouri Estate Planning Inheritance Tax

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

Kansas Inheritance Laws What You Should Know

Kansas Estate Planning Attorney Says To Steer Clear Of These Estate Planning Mishaps

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Free Kansas Small Estate Affidavit Form Affidavit Transferring Certain Personal Property Pdf Eforms